ES Analysis (20250428-0502)

Sentiment: A little bit Bullish

Previous Weekly Analysis:

Over the past month, I’ve been able to consistently and accurately analyze market structure and predict the coming week's movements through technical analysis — a major achievement for me.

However, I still struggle to make profits in intraday trading. The main reason is that I DID NOT follow my clear, structured system, and I often fail to follow trends. My mindset is heavily focused on seeking low-risk, high-reward setups — typically reversal trades — which naturally come with lower probabilities. When a trend does present itself, I'm often stuck in a counter-trend position(this is the reason I DID NOT follow my SL based on the system), making it difficult for me to either close my trade or switch sides. Instead, I tend to add more to the losing position at so-called key support/resistance levels. But in reality, support and resistance are often temporary; what truly persists are the trends and the periods of consolidation between them.

To improve my intraday trading, trade less but efficient, I must strictly follow the trading process I've outlined(Almost same to my system):

Context First: Always identify the trend direction before anything else. Use EMA combinations(20/60/120/240 for 5mins and 20/130 for 30mins RTH, also have the ability to change timeframe if the current ones are not working) across different timeframes to determine the current context and potential future direction.

Trade Setups: No clear setup, no trade. The best setups are breakouts (BO w/, w/o retracement), wedges, double bottoms (DB), double tops (DT), etc, refer to my system.

Swing or Scalp Decision: Decide whether the trade is a swing or a scalp based on the prevailing trend.

Risk Management: Calculate the stop-loss distance. For MES (Micro E-mini S&P 500), $5 per point per contract — ensure the risk fits within my rules. With a $10,000 account, 1% risk per trade means a maximum loss of $100 per trade, which translates to either 20 points per contract or 10 points per two contracts.

Position Sizing: Always start with one contract. Set the stop-loss accordingly(MAXIMUM 20 POINT, check the ATR as well to see whether it is a acceptbale). Only add to the position if the market moves favorably with strong momentum. If the market stalls (e.g. TBTL) without momentum, consider exiting at breakeven.

Exit Strategy: Use trailing stops or other exit strategies as defined in the system.

Important reminders:

Follow the trend, don't try to create one. The market decides how much it can give — not me. If I'm wrong, accept it quickly and move on.

Smaller timeframes should align with larger timeframes, but also remember: reversals often start from the smaller timeframes.

Weekly Chart(Monthly Analysis):

With four days left until the monthly chart closes, there are several key points to watch:

Monthly Chart Observations:

The 20 EMA will be a critical level. Bulls will first aim to close above 5575.

If the monthly bar closes above the 20 EMA, bulls will likely push to close as high as possible, ideally near the monthly open at 5643.75.

Both scenarios suggest there is room for the market to continue its bullish trend if conditions align. Otherwise, market still favor bears.

Weekly Chart Observations:

The EMA rainbow on the weekly chart shows early signs of change: the 20 EMA is about to cross below the 50 EMA. This could signal a potential shift back to a sideways or bearish market.

Next week's candle will be crucial: if the weekly bar closes bearish, it could invite more selling pressure and increase the likelihood of a deeper pullback.

Key Levels to Watch:

For Bulls:

First Target: Close above 5575 (Monthly 20 EMA).

Next Target: Push toward 5643.75 (Monthly Open).

Extension Target: Rally toward 5732 (Weekly 50 EMA).

👉 If bulls can reclaim and hold above 5575 and gain momentum, they could open the path toward 5643.75 and eventually 5732.

For Bears:

First Defense: Keep price below 5575 into the monthly close.

Downside Target: Push toward 5100 — the 50% retracement of the weekly "three pushes" pattern.

👉 If the market remains below 5575, bears will likely strengthen and aim for a deeper pullback, targeting 5100.

Daily Chart:

During the entire bear trend since February, this is only the second time that a daily bar has closed above the 20 EMA with follow-through.

This is a positive sign, suggesting that the market might have a real chance to transition back into a bullish trend, especially considering the signals from the weekly EMA rainbow.

Additionally, it appears that the downward trendline has been broken, although confirmation is still needed — Monday’s price action, especially during premarket, will be crucial in determining the next direction.

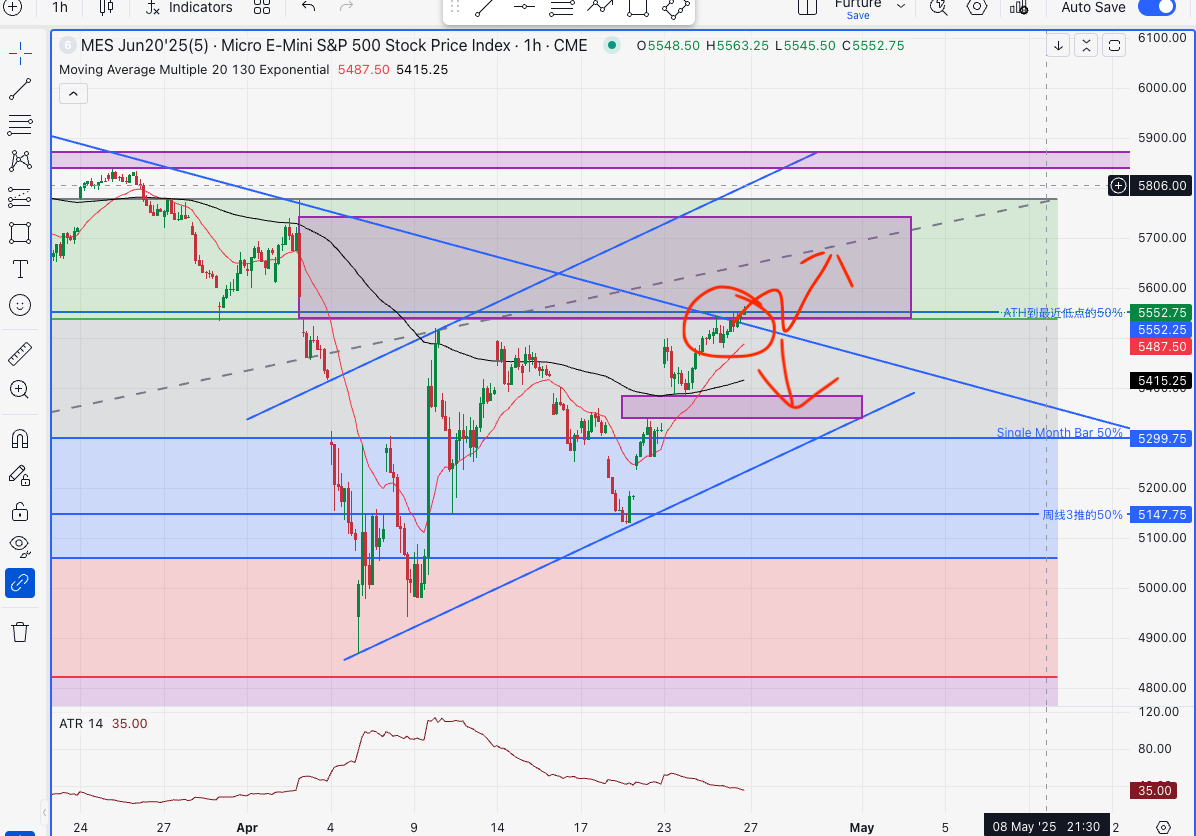

1 hour Chart:

Nothing new to add: we have two gaps, a converging triangle, a weekly bullish trend, a daily bearish trend, and an hourly bullish trend.

The key question is: will the hourly bullish trend be strong enough to reverse the daily bearish trend and allow the weekly bullish trend to continue?